Crypto bookies were poised to disrupt sports betting with promises of instant payouts, anonymity, and borderless wagering, changing the traditional sportsbooks’ reality. The industry was abuzz with predictions of rapid mainstream adoption, and the numbers supported the hype-the crypto betting market went from $50 million in 2019 to $250 million in 2024, a stunning 38% compound annual growth rate.

But here’s a reality check: despite the impressive growth, bettors haven’t fully adopted crypto as their go-to currency for wagering quite the way many experts had predicted. What happened? More importantly, where do crypto bookmakers really shine today?

For bettors looking to sharpen their overall betting strategies, the expert betting guide breaks down how evolving markets and new technologies like crypto are reshaping long-term value and player behavior.

The Gap Between Promise and Reality

When you look at the numbers today, crypto’s infiltration into mainstream betting tells a rather modest story. Only about 17% of all online gambling bets in 2024 were placed using cryptocurrency. That is actually a decrease from higher expectations, since traditional fiat betting grew by 50% while crypto betting expanded by just 15% during the same period.

Why haven’t everyday bettors flocked to crypto bookmakers? The hurdles are relatively simple to identify. One must establish a crypto wallet, interact with cryptocurrency exchanges, and handle the volatility of digital assets. To somebody who simply wants to bet on Sunday’s NBA game, linking their debit card to a traditional sportsbook is far easier than buying Bitcoin, sending it to a wallet, and then on to a betting company.

And let’s not forget the psychological factor: when Bitcoin can swing 10% in a day, bettors worry about whether their deposit of $500 will still be worth $500 tomorrow. Of course, stablecoins like USDT have begun to mitigate the problem, but that’s another concept for the casual bettor to learn.

The regulations haven’t helped matters one whit. Many jurisdictions still insist on KYC verification, even on crypto platforms, which undermines one of crypto’s core selling points: anonymity. So, you’re basically left with the technical complexity of crypto without some of its key benefits.

For bettors who value both stability and profit potential, Sportshub’s odds and scores page helps compare market efficiency between traditional and emerging platforms, including crypto books that are gaining traction in 2025.

Where Crypto Bookmakers Really Shine

For high rollers and professional bettors, these bookmakers are dominant because if you’re betting big figures regularly, the traditional sportsbooks will become a problem quickly: they will limit your account, slow-play your withdrawals, or ban you outright for winning too much consistently. It’s a pretty well-documented problem in the industry-traditional books want recreational losers, not sharp winners.

Crypto platforms flip this script altogether. Top crypto bookmakers embrace high-rollers with open arms. You can easily bet with no need to worry about restrictions on your account. More importantly, these sites do not punish you for winning, which is a game-changer for serious bettors.

The financial advantages are huge, too. Crypto sportsbooks usually have better odds than their traditional counterparts. For NFL betting, you’ll find the point spreads generally at -105 instead of the standard -110 on traditional books. That might sound minor, but it translates into a 2-3% better payout on every bet. Over the course of a full season of heavy betting, that edge adds up to significant money.

Transaction speed is important when one is moving large figures: while other sportsbooks will take 1-3 business days for a $50,000 withdrawal with several verification steps and limits on how much you can withdraw, with crypto, you get instant to 24-hour processing for that amount with zero intermediary fees.

And when it comes to privacy, for prominent punters and those who are more discreet, crypto’s minimal KYC requirements offer peace of mind that traditional platforms cannot match. You are not advertising your betting activity to banks, payment processors, or judgmental financial institutions.

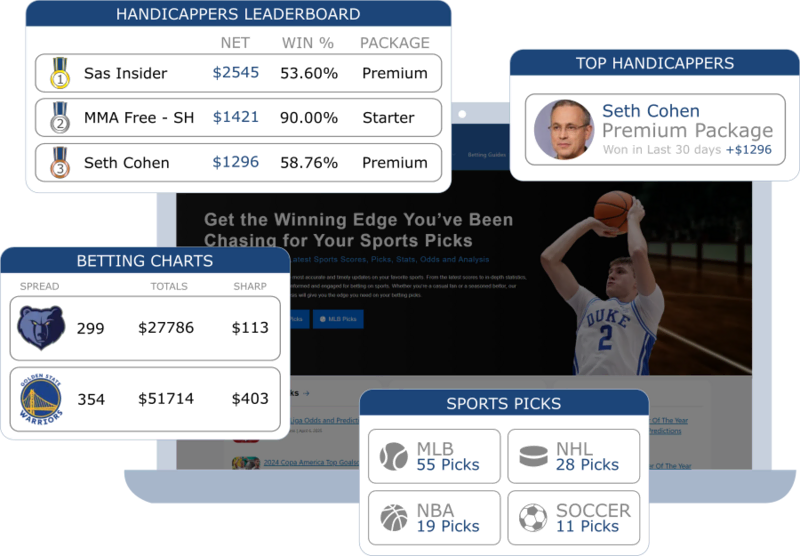

For sharp bettors tracking edge opportunities, visit Sportshub’s picks leaderboard to see how verified cappers are adapting to evolving market trends across both fiat and crypto sportsbooks.

Changes in the Industry

So, are crypto bookmakers the future? Not quite as simple as a ‘yes’ or ‘no’ answer. They’re carving out a highly profitable niche rather than supplanting traditional betting.

The market is maturing in interesting ways: 65% of all crypto wagers are now via mobile betting, while the platforms are integrating DeFi concepts such as staking and liquidity pools. We have projections of $400 million by 2028, representing a sustainable 12.5% annual growth, not the explosive expansion some had predicted.

Regulatory frameworks are slowly catching up, too, with jurisdictions like Malta and Estonia issuing crypto-specific licensing. This regulatory clarity will likely boost institutional confidence at the probable cost of limiting some of crypto’s wild-west appeal.

The Verdict

The betting industry is undergoing a segmentation. For casual bettors who favor ease and familiarity, traditional sportsbooks will remain the obvious destination. But for high rollers, sharp bettors, and those who value privacy and speed over convenience, crypto bookies offer advantages their traditional counterparts simply cannot match. The future might not be about one replacing the other, but each serving the needs of different bettor profiles.

The future might not be about one replacing the other, but about each serving the needs of different bettor profiles—an evolution that Sportshub continues to track across odds, analytics, and technology in its bettors handbook.